I never thought I’d need travel insurance for Singapore—until I did. While biking through Southeast Asia, another traveler accidentally crashed into me, leaving me with a small burn so I needed to go to see a doctor.

Thankfully, I had travel insurance, which covered my visit and medication. If I hadn’t, I would have paid out of pocket, cutting into my travel budget.

While Singapore is one of the safest and most well-developed countries in the world, accidents, medical emergencies, or travel mishaps can still happen.

In this guide, I’ll break down why SafetyWing’s Nomad Insurance is a great choice for travelers heading to Singapore.

I’ll cover what’s included, how much it costs, and real-life scenarios where you’d need it!

Why Choose SafetyWing Travel Insurance for Singapore?

If you’re a traveler, digital nomad, or remote worker heading to Singapore, SafetyWing offers flexible and affordable travel insurance.

Unlike traditional travel insurance that requires a fixed start and end date, SafetyWing operates on a subscription basis.

This means you can start coverage anytime, extend it automatically, or cancel it when you no longer need it.

Here’s why SafetyWing stands out:

- Affordable Pricing – Competitive rates compared to traditional travel insurance.

- Worldwide Coverage – Singapore is included, along with 175+ other countries.

- Subscription Model – Pay for insurance as long as you need it, without upfront bulk payments.

- Medical + Travel Protection – Covers medical emergencies, trip interruptions, and lost luggage.

Whether you’re visiting Singapore for a few weeks or planning to live there as a nomad, SafetyWing keeps you covered without breaking the bank.

SafetyWing Nomad Insurance Plans – Which One Should You Choose?

Option #1: The Essential Plan – Budget-Friendly Travel Coverage

If you’re looking for basic coverage that protects against common travel mishaps, the Essential Plan is a great choice.

What’s Included?

✔ Emergency Medical Expenses – Covers up to $250,000 USD for hospital visits, injuries, and sudden illnesses.

✔ Emergency Evacuation – If you need urgent transport to a different country for better medical care.

✔ Trip Interruption – Get reimbursed for unused bookings if you have to cut your trip short.

✔ Lost Checked Luggage – Compensation if an airline loses your bags.

Who Is Safety Wings’ Essential Plan For?

- Budget travelers who want basic travel and health protection.

- Tourists staying in Europe or Asia for example, for a short visit.

- Digital nomads who are mostly healthy but need emergency coverage.

How Much Does the Essential Plan Cost?

- Starts at $56.28 USD for 4 weeks (ages 10-39). The price increases by approximately $40 for every age range.

- You can also add insurance for adventure sports and equipment protection, like your phone.

- Prices vary based on age and duration of coverage.

Free PDF Packing List

Sign up for my monthly newsletter and get a printable travel checklist. Not just the essentials, a FULL packing list for any trip!

Option #2: The Complete Plan – Full Healthcare and Travel Protection

The Complete Plan is for travelers who want broader coverage, including check-ups and mental health support.

What’s Included?

✔ Everything in the Essential Plan, PLUS:

✔ Higher Medical Coverage – Up to $1,500,000 USD for health emergencies.

✔ Routine Check-ups & Preventive Care – Covers doctor visits, screenings, and vaccinations.

✔ Mental Health Support – Therapy and counseling sessions included.

✔ Maternity & Cancer Treatment – Protection for pre-natal care and serious health conditions.

Who Is It For?

- Digital nomads and long-term travelers who want full healthcare while abroad.

- Expats living in Singapore who need regular doctor visits.

- Remote workers who want mental health and maternity coverage.

How Much Does the Complete Plan Cost?

- Starts at $150.50 USD per month (ages 18-39).

- More expensive, but comprehensive.

- Extra coverage for Adventure Travel, travel to Hong Kong, Singapore, and the US.

Which Plan Should You Choose?

- If you want affordable, basic coverage, go with Essential.

- If you want full medical protection, choose Complete.

When Might You Need Travel Insurance in Singapore?

Even in a country as safe and modern as Singapore, unexpected problems can arise. You can’t always fight off stomach issues when trying new foods, or even catching the flu on the flight over.

Here are a few scenarios where SafetyWing insurance would save the day:

1. You Get Sick or Injured on Your Trip

Singapore’s healthcare system is top-notch but expensive. A visit to a private hospital can cost hundreds to thousands of dollars.

If you have a sudden illness, an allergic reaction, or get injured, travel insurance covers hospital bills, medications, and even emergency evacuation if needed.

💡 Example: You eat street food at a hawker center and end up with stomach issues. Without insurance, you’d pay out of pocket for a hospital stay. With SafetyWing, your treatment is covered.

Pro Tip for Wifi:

To stay connected to the internet while traveling, I use an E-sim called Airalo. You can purchase the e-sim at any time, as long as your phone is E-sim compatible.

2. Your Flight Gets Canceled or Delayed

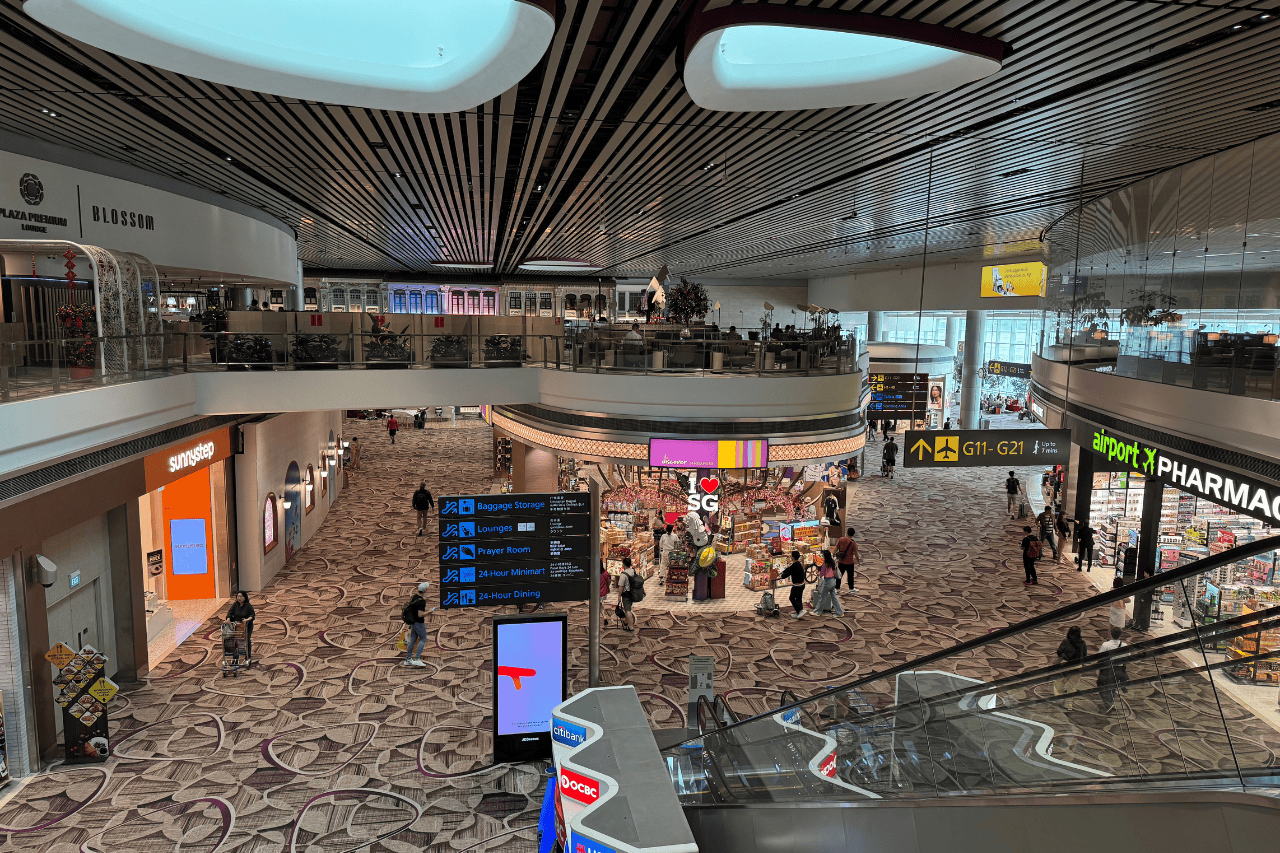

Flights to and from Singapore’s Changi Airport are usually smooth, but unexpected weather or airline issues can lead to delays.

If your flight gets canceled and you need to book another one or stay overnight, trip interruption coverage helps with extra costs.

💡 Example: A typhoon in Southeast Asia cancels your connecting flight. SafetyWing helps you rebook or covers a hotel stay.

3. Your Luggage Gets Lost or Stolen

Singapore is generally safe, but mistakes happen—luggage can get lost in transit, or in rare cases, stolen in crowded places.

SafetyWing helps reimburse you so you can replace your essentials.

💡 Example: You arrive in Singapore, but your airline loses your checked bag. SafetyWing gives you money to replace lost items.

Singapore Accommodation Options:

- Hostel: The Pod Boutique Capsule Hotel

- Mid-Level Hotel: Hilton Garden Inn

- High-End Hotel: Marina Bay Sands

Testimonials – What Travelers Say About SafetyWing

Real travelers love SafetyWing for its affordability and reliability. Here are some testimonials from their website:

⭐️ “SafetyWing saved me when I got sick in Thailand. My hospital bills were covered, and the process was smooth!” – Stay Wild Travels

⭐️ “I had a last-minute trip extension and could easily renew my coverage. So much easier than traditional insurance.” – Product Hunt

⭐️ “Great customer service and claims process. Affordable and perfect for nomads!” – SafetyWing Reviews

Bonus: SafetyWing Insurance for Remote Teams

If you manage a team of remote workers, SafetyWing also offers Remote Health Insurance for companies.

This plan covers employees in 175+ countries, providing full health coverage, check-ups, and dental/vision benefits.

💡 Perfect for: Startups, freelancers, and companies with employees working remotely from different locations.

👉 Learn more: SafetyWing Remote Health

Final Thoughts – Should You Get SafetyWing Travel Insurance for Singapore?

If you’re traveling to Singapore, the decision to get travel insurance is up to you. What I always like to say is – better safe then sorry!

Whether you’re a short-term visitor or a long-term digital nomad, SafetyWing offers affordable and flexible coverage that protects you from unexpected costs.

✅ Go for the Essential Plan if you just need emergency coverage and travel protection.

✅ Choose the Complete Plan if you want full healthcare, mental health, and maternity benefits.

Singapore is an incredible place to visit, and with the right insurance, you can travel stress-free.

👉 Get covered today: SafetyWing Nomad Insurance

SafetyWing Travel Insurance FAQ

Do I need travel insurance for Singapore?

Yes, travel insurance is essential to cover medical emergencies, trip interruptions, and lost luggage in case of unexpected events.

Does SafetyWing cover medical expenses in Singapore?

Yes, both Essential and Complete plans cover medical emergencies, hospitalization, and doctor visits while you’re in Singapore.

What happens if I get sick in Singapore?

You can visit a hospital or clinic, and SafetyWing will reimburse you for covered medical expenses according to your plan.

Does SafetyWing cover COVID-19 in Singapore?

Yes, SafetyWing covers COVID-19 treatment, testing, and hospitalization if you contract the virus during your trip.

Can I buy SafetyWing insurance after arriving in Singapore?

Yes, you can purchase SafetyWing insurance at any time, even if you’re already in Singapore.

Does SafetyWing cover adventure activities in Singapore?

Yes, but coverage depends on the activity, so check the policy details to ensure your specific adventure is included.

What if my flight to Singapore gets canceled?

SafetyWing’s trip interruption coverage can help with rebooking fees and additional travel costs.

How do I file a claim with SafetyWing?

You can submit a claim online through their website, and their team will process it as quickly as possible.

Can I extend my travel insurance while in Singapore?

Yes, SafetyWing operates on a flexible subscription model, so you can extend or cancel anytime.

Does SafetyWing cover stolen or lost baggage?

Yes, they provide compensation for lost checked luggage, helping you replace essential items.

Singapore Travel Guides